7.0 OWNER BUILDER INSURANCE

Insurance is a necessary evil on all projects, and one of those areas we as owner builders, never want to have to deal with.

But things do go wrong, accidents happen and not everybody is as honest as you would like.

You, your site, the people working on or visiting the site, the materials and the construction itself should be insured.

All the money you can save by being an organised owner builder will be lost quicker than a heartbeat if inappropriate or inadequate insurance policies are held.

Following is a list of the insurances you need to consider before embarking on your owner builder project.

In addition to holding your own insurances, you need to ensure each and every trade contractor you use is correctly covered and has in place all necessary insurances to cover them, their workers and their work.

Abacus Training advises its Owner Builders that:

All policies and all insurance companies are different in respect to what is covered and to what extent.

It remains your responsibility to ensure you read and fully understand the Product Disclosure Statement (PDS) for any policy you are considering, to satisfy yourself that you are getting what you expect.

The information provided below is from the Department of Fair Trading website which outlines insurance requirements for building projects including owner builders.

Familiarise yourself with the requirements.

7.1 OWNER BUILDERS and BUILDERS ALL RISK INSURANCE

Sometimes known as Construction or Contract Works Insurance.

This policy covers the works on the site and the material securely stored on site from theft, fire, storm, wilful damage etc.

It can also be extended to cover items in transit and other defined events as specified in the policy.

As with all insurance, be certain you understand the specific inclusion and more importantly exclusions.

Also what if any excess is included and how it affects the premium paid.

Owner-builders, churches and non-profit organisations may be eligible for levy exemptions or discounts. The maximum levy discount is 50%. The minimum levy paid is $50.

Owner-buildersOwner-builders holding an Owner Builder Permit issued by NSW Fair Trading may be entitled to a reduction in the levy. Use the levy portal to apply for an owner-builder partial levy exemption. You can apply at the time of paying the levy or within 12 months of payment.

Owner-builder exemptions are processed automatically for work costing less than $500,000 with a voluntary component of less than 50%.

7.2 OWNER BUILDER PUBLIC LIABILITY INSURANCE

While it remains your responsibility to make the site as safe as is possible and to put in place certain risk management strategies, accident still do happen.

It may be a visitor to the site, a friend, a relative or even a member of the general public who falls, trips or in some way injures themselves on the construction site or is injured as a result of any works that are being undertaken on your site.

Should they seek to claim damages, you will need to be insured to cover any associated costs.

Quite often, a lower premium can be achieved through insuring for Construction (All Risk) and Public Liability with the one insurer.

7.3 OWNER BUILDER and WORKERS COMPENSATION INSURANCE

WorkCover, or workers compensation insurance is to provide for loss of income due to accident or injuries received during the conduct of works on or associated with the a workplace.

It remains a legal obligation for anyone who employ staff on a full or part time basis to provide adequate workcover insurance.

As the Owner-Builder and therefore the Principal Contractor, it is your responsibility to:

- Provide Workers Compensation for people employed on your site, or

- Ensure all trades people and contractor carry their own policies and that these policies are current and appropriate.

You should contact workcover prior to engaging contractors to ensure you have an understanding of your liability in respect workers compensation should anyone you have engaged fail to meet their workcover obligations.

7.4 OWNER BUILDER and WARRANTIES

Many of the PC Items you purchase will come with a manufacturer’s warranty.

There are several ways to retain copies of these for claims that may result from failures etc.

We recommend keeping them in a separate file either, scanned and retained electronically or in the original hard copy format.

Whichever way you decide upon, make certain you can readily access tehm as required and that all necessary information or supporting documentation is retained including:

- Receipt of purchase

- Store Invoice

- Copies of any completed warranty forms

- Details and proof of extended warranty purchased

Insurance is a necessary evil on all projects, and one of those areas we never want to have to deal with.

But things do go wrong, accidents happen and not everybody is as honest as you would like.

You, your site, the people working on or visiting the site, the materials and the construction itself should be insured.

All the money you can save by being an organised owner builder will be lost quicker than a heartbeat if inappropriate or inadequate insurance policies are held.

Following is a list of the insurances you need to consider before embarking on your project.

In addition to holding your own insurances, you need to ensure each and every trade contractor you use is correctly covered and has in place all necessary insurances to cover them, their workers and their work.

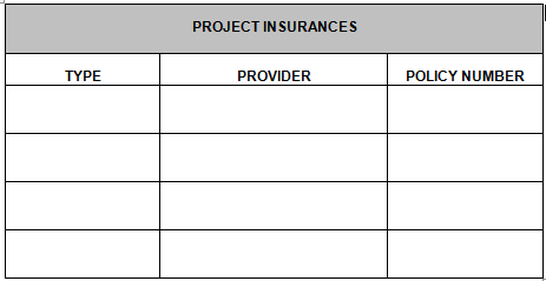

At the end of this section we have included an insurance register which can be used to record and update all insurance details for the project.

Owner Building Solutions Australia advises that:

All policies and all insurance companies are different in respect ot what is covered and to what extent.

It remains your responsibility to ensure you read and fully understand the Product Disclosure Statement (PDS) for any policy you are considering, to satisfy yourself that you are getting what you expect.

7.5 OWNER BUILDER HOUSEHOLDERS INSURANCE

General Household Insurance may cover some of the works conducted on site, but be careful, again check PDS and ask questions.

Contact SAFEWORK and discuss a Household Workers’ insurance policy.

This will cover your cleaner, your nanny or your gardener if they injure themselves in the course of providing paid services to you at your residence.

The area of workers engaged on your project is a little ‘grey’, and we would suggest you contact WorkCover and take out the policy that is best suited to your specific requirements.

WorkCover can be contacted on 1300 362 128

7.6 Professional Indemnity

Don't forget the professionals you engage such as Draftsmen, Architects, Private Certifiers, Engineers etc.

Make certain they have appropriate insurance to cover the works for which they design or certify.

This is easily overlooked and whilst rarely occurs, these professional can make mistakes, errors that could prove extremely costly to any owner builder unfortunate enough to be affected by their decisions.

Finally,

It is advisable to keep a register of all insurances you hold current in respect the owner-builder works you are undertaking.

The following table is an extract from the Design Brief Checklist which should as a minimum; include the policy details as indicated.

Keep it in the master file for the project to allow easy access to the information.

Remember, it is advisable to include the insurance details of each contractor on the relevant signed contract.

This information should include:

This information should include:

- Insurer details

- Policy Number

- Type of Cover

- Expiry date

- Name of the Insured.